The Geography of Green: Where Does Your Money Stretch Furthest Across the U.S.?

In a recurring theme echoed through many annual discussions, income and expenditure continue to dominate the economic conversation in the United States. As incomes steadily rise, there is a corresponding uptick in spending, reflecting a broader capacity for Americans to enhance their living standards through increased financial means. This progression allows individuals to allocate more resources toward their lifestyles and needs. However, this growth in income and spending has not been without its drawbacks, as it also ushers in challenges linked to inflation, which can dilute the purchasing power of these rising incomes. In today's discussion, we delve into the nuances of income and expenditure variations by state and metropolitan area, aiming to illuminate the diverse economic landscapes across the nation and how they influence the financial dynamics of their residents.

In our exploration, we will examine the significant regional variations that characterize income and spending patterns across the United States. The influence of geography on economic circumstances is striking: in some areas of the country, an annual income of $55,000 is considered sufficient for a stable financial life, whereas, in other regions, the threshold for similar financial comfort may be as high as $80,000. These stark contrasts highlight how deeply regional factors can affect economic outcomes for individuals and families. With the national per capita income recorded at $68,550 in 2023, according to the Federal Reserve Economic Data (FRED), a closer look at the income levels in various states and metropolitan areas can reveal intriguing stories about the economic diversity and disparities that exist within our nation.

Naturally, income is a key focus of interest for many. To provide a comprehensive understanding, we will start with a detailed breakdown of per capita income, that is, income per person, analyzed both by state and metropolitan region for the year 2023, as reported by the Federal Reserve Economic Data (FRED). This analysis will offer a clear view of how income levels vary geographically, shedding light on economic conditions in different parts of the country and how they compare on a national scale.

It is not unexpected that Washington D.C., which functions both as the nation's capital and as a vibrant urban center, records the highest income levels in the United States. Shifting the focus to a state-level analysis reveals that Massachusetts, Connecticut, New Jersey, California, and Washington state lead the nation with the highest income figures. To provide a detailed perspective on economic standings across the country, here is a comprehensive ranking of the top 25 regions, including Washington D.C., showcasing where each area ranks in terms of per capita income:

Zooming in further on income levels, we turn to a more localized analysis using 2022 data to explore various metropolitan areas, where some findings might catch many readers off guard. While the booming tech industry has undoubtedly enhanced income figures in several West Coast cities, it is particularly fascinating to observe how the oil and gas industry has propelled Midland, Texas, a mid-sized city in western Texas, to the forefront of metropolitan income levels nationwide. Hot on its heels is the San Jose-Sunnyvale-Santa Clara metropolitan region in California, better known as Silicon Valley. This technology hub consistently achieves top rankings for income due to its role as the home base for tech behemoths like Apple, Google, Meta, and Nvidia, drawing high-earning professionals to the area.

The Naples-Marco Island area, located on Florida's southwest coast, secures the third spot in our income ranking. This region is celebrated for its luxury and has become a favored destination for affluent retirees and tourists, attracting a demographic that significantly contributes to the area's high average income levels.

Now, let's explore the top 25 metropolitan areas ranked by income level (U.S. Bureau of Economic Analysis):

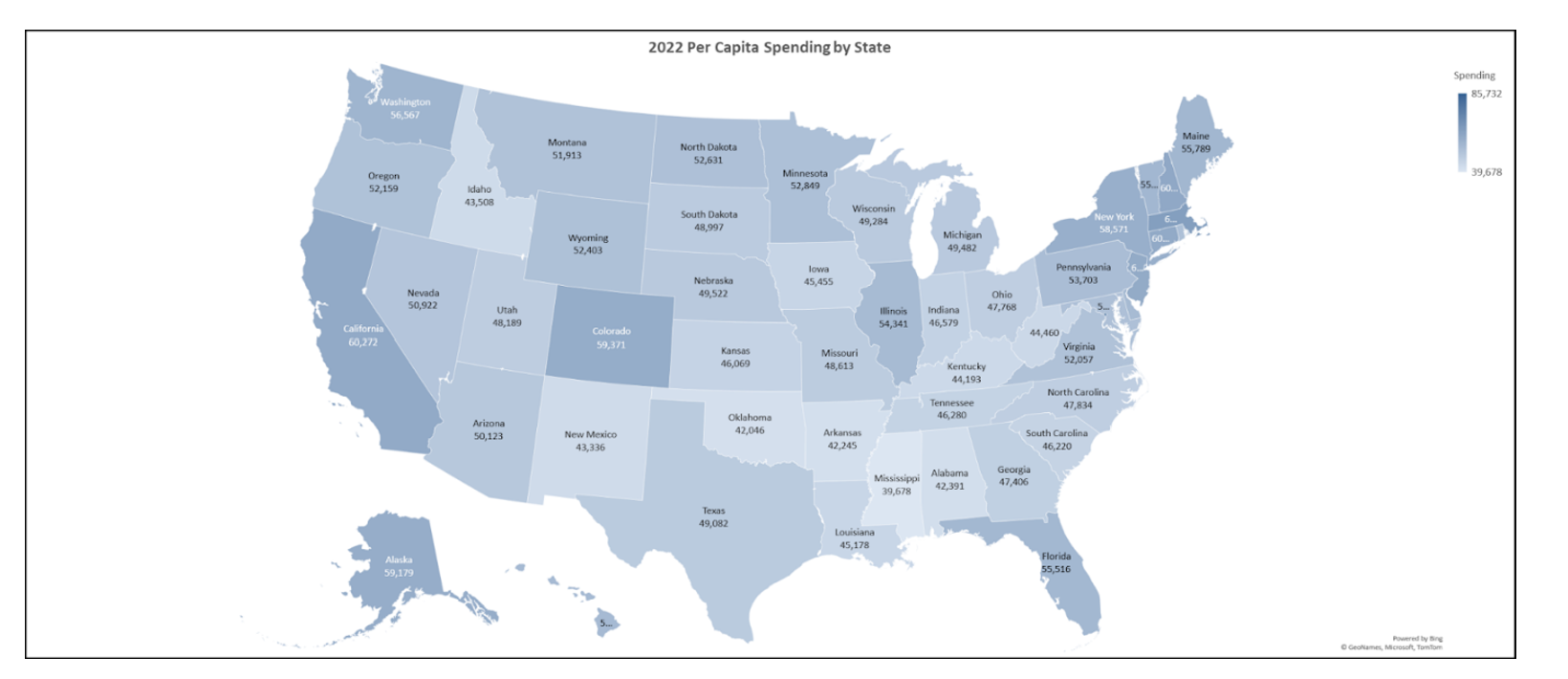

While it is encouraging to see a variety of states and metropolitan regions enjoying high income levels, it is essential to recognize that high incomes frequently lead to increased prices and spending. Consequently, we will now focus on analyzing states based on their spending levels. For this analysis, we will rely on data from 2022, as comprehensive spending data for 2023 has yet to be fully available. This exploration will help us understand how higher incomes correlate with these regions' consumer behavior and economic activity.

It is important to note that both 2022 and 2023 have witnessed upticks in spending and incomes across numerous states, which means the figures we discuss may only partially align with the very latest data. However, the value of this historical data lies in the insights it provides, allowing us to compare income levels across various geographic regions relative to each other. This comparison not only sheds light on regional economic disparities but also helps illustrate how different areas have responded to economic trends over the years.

Indeed, it is noteworthy that many of the states with the highest income levels also exhibit substantial spending rates. A critical factor to consider here is the discrepancy between income and spending levels, which provides insights into these regions' financial health and lifestyle sustainability. We will explore this disparity in greater detail after reviewing the per capita spending figures by state.

Unsurprisingly, Washington, D.C., leads the pack in terms of spending, a reflection of its high income and cost of living. Following closely are states like Massachusetts, New Hampshire, Connecticut, and California, all known for their robust economies and high cost of living. Below, we provide a detailed list of the top 25 most expensive states to live in, including Washington, D.C., according to the latest data from the U.S. Bureau of Economic Analysis:

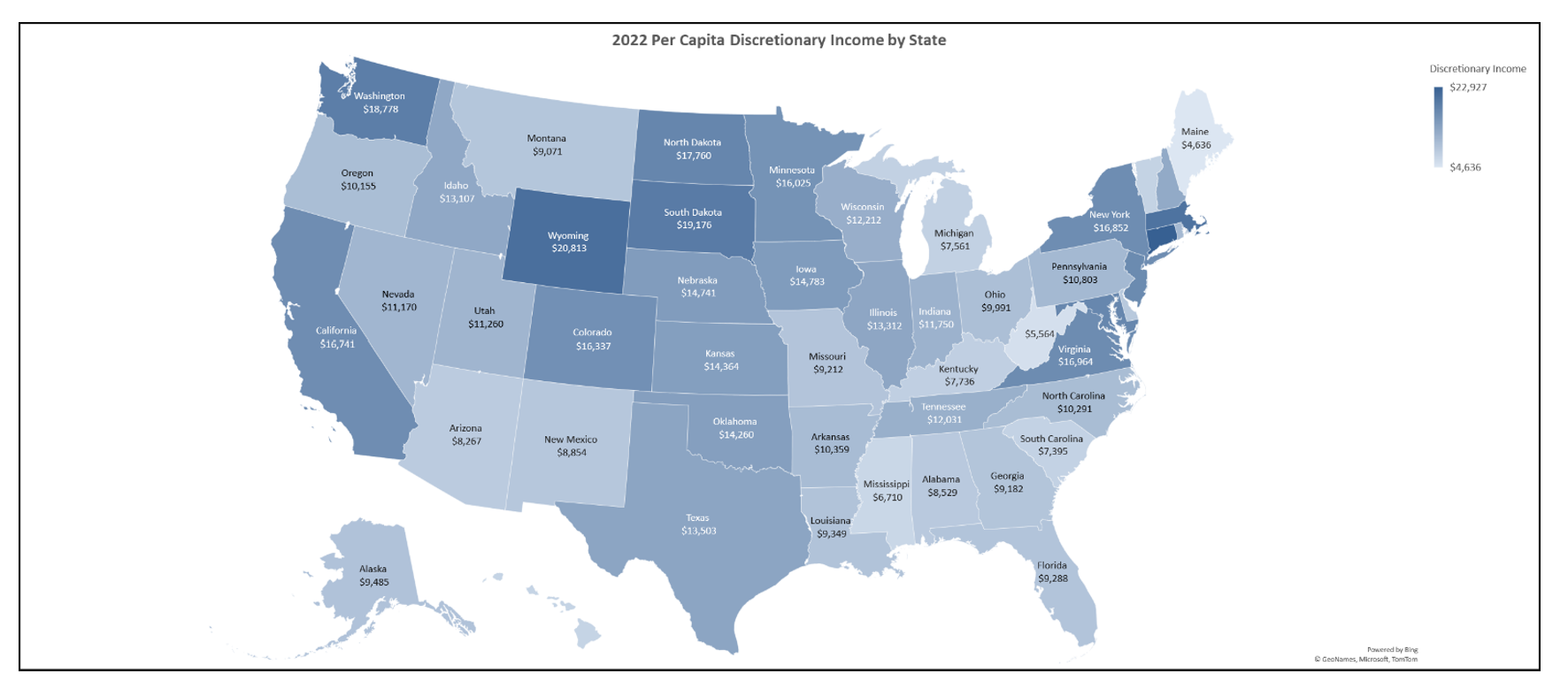

Having explored the states in terms of per capita income and spending, we now turn our attention to assessing which states offer the highest value for your money, essentially giving you the most bang for your buck. While a high income is undoubtedly appealing, it is equally, if not more, crucial to consider how much of that income you actually keep after expenses. This balance between earnings and expenditures plays a key role in determining the actual economic benefit of living in a particular state. Consider this: would you rather earn $100,000 a year but spend $90,000 of it, or earn $80,000 but only spend $65,000? Understanding this ratio of income to spending can significantly influence decisions about where to live and work, emphasizing the importance of not just earning well but also managing and retaining those earnings effectively.

In the following graphic, we will delve into the concept of discretionary income by examining how much per capita income remains after accounting for spending. To ensure a coherent and accurate comparison, we will use income data from 2022, aligning it with the most recent spending data available from the same year. This analysis will help visualize the proportion of income that individuals in various states are able to retain for savings and non-essential expenditures, providing a clearer picture of financial health and economic freedom across different regions.

In conclusion, our exploration of income and spending patterns across the United States highlights significant regional differences in economic health and personal finance management. Several states emerge as particularly advantageous when assessing how much of your income remains after covering essential expenses. Connecticut, Wyoming, Massachusetts, South Dakota, and Washington State are at the forefront, offering residents substantial discretionary income. These states stand out not only for their higher income levels but also for the proportion of income that residents can retain after managing necessary expenditures like housing, utilities, food, and insurance.

This surplus income, which can be channeled into savings, investments, or non-essential spending, makes these states some of the most financially beneficial places to live in the U.S. The ability to maintain a higher standard of living while managing costs effectively is a key attribute of these regions. Understanding the balance between income and expenses in different states provides valuable insights for anyone looking to optimize their financial situation, whether they are considering relocating, investing, or simply aiming to get the most out of their current financial environment.

Here is a breakdown of the top 25 states ranked by discretionary income:

References:

Federal Reserve Bank of St. Louis. (n.d.). Federal Reserve Economic Data: Your trusted data source since 1991. FRED. https://fred.stlouisfed.org/release/tables?rid=110&eid=257197&od=#

News release. Personal Consumption Expenditures by State, 2022 | U.S. Bureau of Economic Analysis (BEA). (n.d.). https://www.bea.gov/news/2023/personal-consumption-expenditures-state-2022

News release. Personal Income by County and Metropolitan Area, 2022 | U.S. Bureau of Economic Analysis (BEA). (n.d.). https://www.bea.gov/news/2023/personal-income-county-and-metropolitan-area-2022

Personal income per capita. FRED. (2024, March 28). https://fred.stlouisfed.org/series/A792RC0A052NBEA